Blockchain has moved beyond the hype and is now being embraced across industries for its ability to save money, build trust, and boost competitiveness in the digital economy. As more businesses transition from Web2 to Web3, even companies in more traditional industries are realising the benefits of blockchain in enhancing security and transparency, and cutting out intermediaries. Blockchain is here to stay—so let’s explore how Kumo, a new venture by Vodworks, can help you adopt this transformative technology.

Vodworks’ Blockchain Expertise

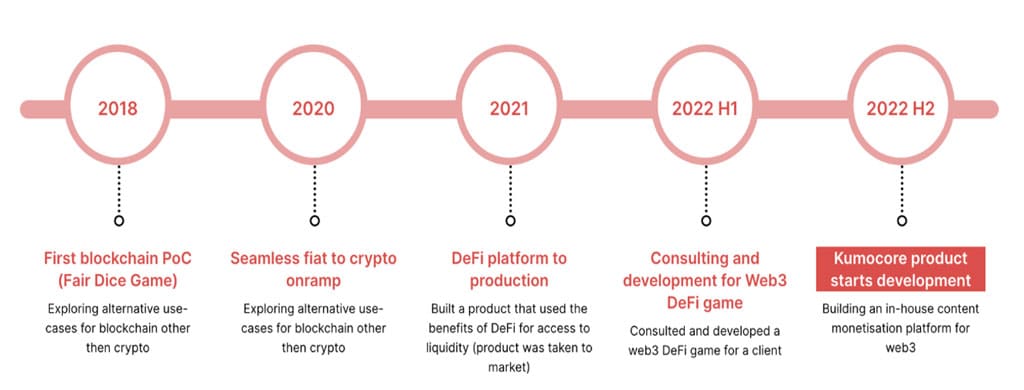

Vodworks has been a leader in software development, providing bespoke solutions for global clients such as EA, Canal+, and True Corporation. Specialising in outsourcing and augmented teams, Vodworks supports partners across industries like Media & Entertainment, Telecommunications, Fintech, and Compliance. Since 2018, their R&D team has been committed to advancing Web3 and blockchain adoption, developing decentralised finance (DeFi) platforms and Web3 games to overcome mass adoption challenges.

Introducing Kumo: Blockchain Where It Matters

Originally a Vodworks project, Kumo is now an independent company offering an enterprise blockchain platform and custom blockchain development services. Kumo delivers real-world value through practical use cases such as:

- Loyalty Programs: Transform customer engagement with tokenized rewards.

- Gaming: Enable the creation and trading of in-game assets.

- Identity Management: Issue secure, verifiable digital credentials.

- Fan Engagement: Deepen fan relationships through interactive experiences.

- NFT Marketplaces: Launch marketplaces in hours.

- Real Assets: Tokenize physical objects to improve security and transparency.

Trusted by Avarik Saga, Veve, NiiFi, Pixel.Inc, and more, Kumo partners with Web3Auth, Microsoft, Coinbase, Metamask, and others to make blockchain accessible and impactful for all clients.

“Kumo’s ongoing development and successful project implementations highlight our commitment to pushing the boundaries of blockchain technology.”

— Sakib Mirza, CEO of Kumo & Vodworks

Your Future with Kumo

Whether you’re exploring blockchain for the first time or you’re an established Web3 company, Kumo’s global team is ready to tackle your challenges and deliver results. Vodworks will continue to provide world-class software development across industries, while Kumo focuses exclusively on blockchain and Web3.

Reach out to Kumo for a free consultation and start building the future of tech today.

Have you read?

Most Fashionable Countries. Best Countries For Business Expats. Best Non-Native English Speaking Countries. Countries With the Largest Household Size. Best Countries For Older People To Live In.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine’ prior written consent. For media queries, please contact: info@ceoworld.biz

CEOWORLD magazine – Latest – Tech and Innovation –